- Our Blog

Download PDF

What should consumers and investors expect in the fast-approaching season of spending?

The holiday selling season represents around 25% of annual retail sales and has always been an important catalyst for investors. When it comes to understanding what this holiday season may hold, it's helpful for investors to consider how the experiences of the past two years might inform retailers’ expectations, especially around supply and demand. We also need to consider how consumers are faring in a much more uncertain macroeconomic environment.

Ghost of Christmas past: Supply and demand challenges

Back in 2021, consumer demand was strong coming out of the pandemic, but supply chain issues resulted in longer lead times for products to reach stores and inventories were depleted quickly.

In response, retailers prepared for 2022 by increasing inventory, but demand plummeted as consumers faced tougher-than-expected economic conditions, including high food and fuel inflation. As a result, retailers sat on inventory, forcing them to be very promotional, which hurt both sales and margins.

Ghost of Christmas present: Consumers grapple with uncertainty

Fast forward to today, we find that while inventory levels are more balanced compared with the excess of 2022, the demand picture remains uncertain. Inflation has moderated, but the outlook for consumers has otherwise weakened. Despite recent improvements in real wages, many low-income consumers are still living paycheck to paycheck.

The cost of living, including food and fuel, remains a significant concern, and we’re seeing consumer spending dedicated to “needs” (and food in particular) rather than “wants.” Even higher income consumers are feeling the pinch with increased market volatility, a slowing housing market and employment uncertainty.

Coal for some retailers? Finding winners and losers

Given the more challenging spending environment, we expect to see variation across the retail landscape this holiday season.

|

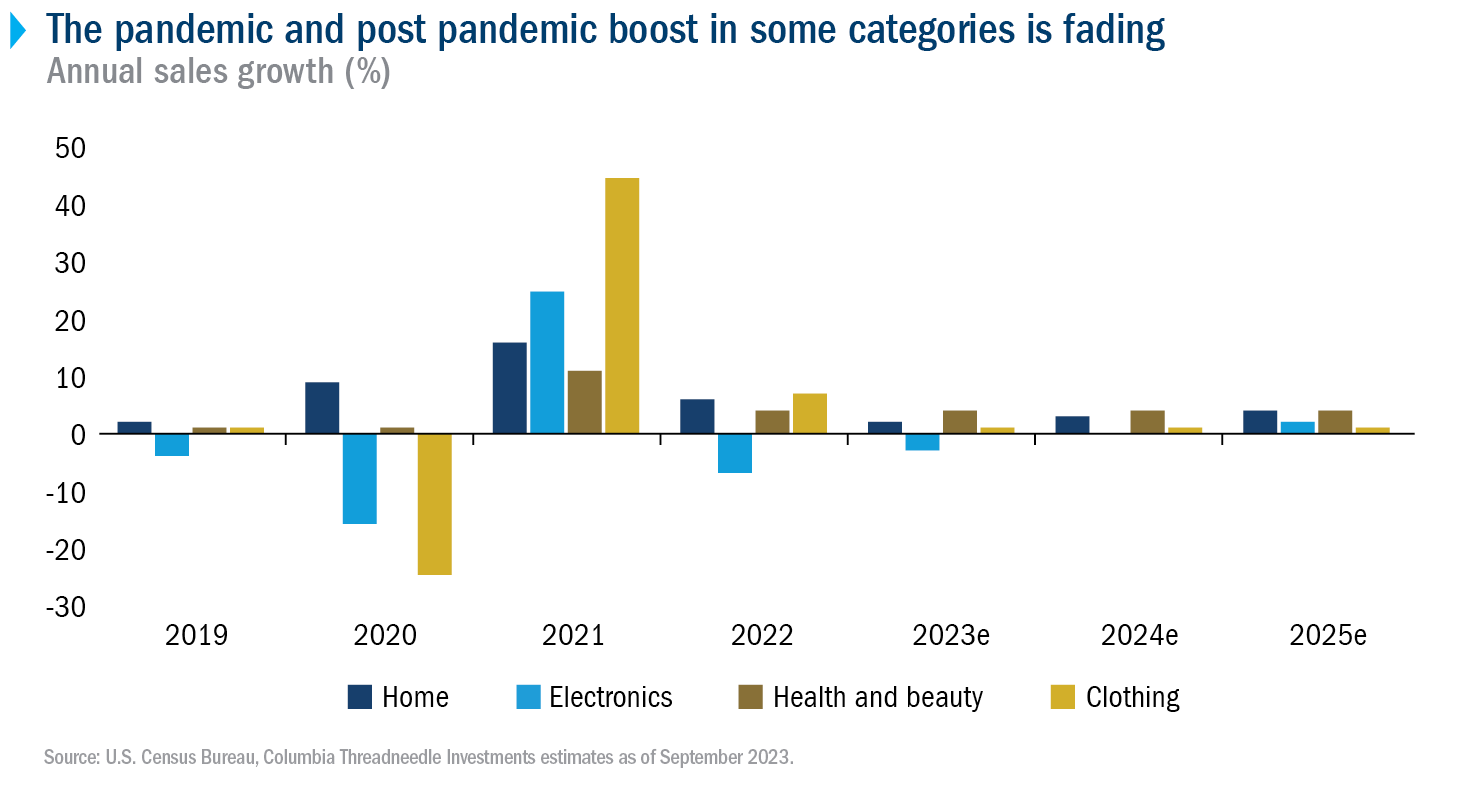

Big-ticket COVID-era winning categories like consumer electronics and home goods are expected to struggle due to oversaturation. |

|

|

Businesses that have focused on changing trends will fare better. Athletic wear and beauty products stand out as these categories align with health and wellness trends, and innovation in these categories has kept consumers engaged. |

|

|

Value-focused retailers are also well-positioned, as consumers are becoming increasingly budget-conscious as economic uncertainties have led shoppers to seek bargains. We’re seeing off-price retailers, e-commerce and value-focused stores increasingly winning over customers. |

Ghost of Christmas future: Price discounts

Promotional sales have long been a holiday tradition, and this year companies may employ them to boost traffic. We don’t expect promotions to be excessive but we may see retailers announce sales earlier in the season to help smooth out holiday shopping peaks and troughs.

In the end, we think that the success of the holiday season (and the year) is going to come down to the wire for retailers. And while they are better positioned in terms of inventory, consumers are in no rush and have the upper hand in waiting for deals.

For investors it will be important to identify areas of opportunity, notably in athletic wear and beauty. The prevailing theme appears to be value, as consumers seek affordability and bargains in an uncertain economic landscape. Retailers and investors remain defensive in their positioning, as it is difficult to identify a catalyst for accelerating demand heading into 2024.