Why grandparents have greater incentive to own 529 accounts

Big changes to the FAFSA process mean grandparents can finally help pay for college without worrying about the “financial-aid trap.”

Because of changes to the Free Application for Federal Student Aid (FAFSA), students will no longer have to disclose cash support. That means effective for the 2024–2025 school year, grandparent-owned 529 accounts will no longer impact a student’s eligibility to receive needs-based financial aid.

Say goodbye to the financial-aid trap

529 plans are generally considered the most effective way to save for education-related expenses. But in the past, treatment of grandparent-owned accounts had been criticized and even garnered the term financial-aid trap from savingforcollege.com. Why? Because while families applying for aid aren’t required to disclose grandparent-owned 529 account assets on the FAFSA, they are required to disclose any cash support the student receives. So, if distributions are taken from grandparent-owned accounts and used for education expenses, the student is expected to show the distribution as income on future FAFSAs.

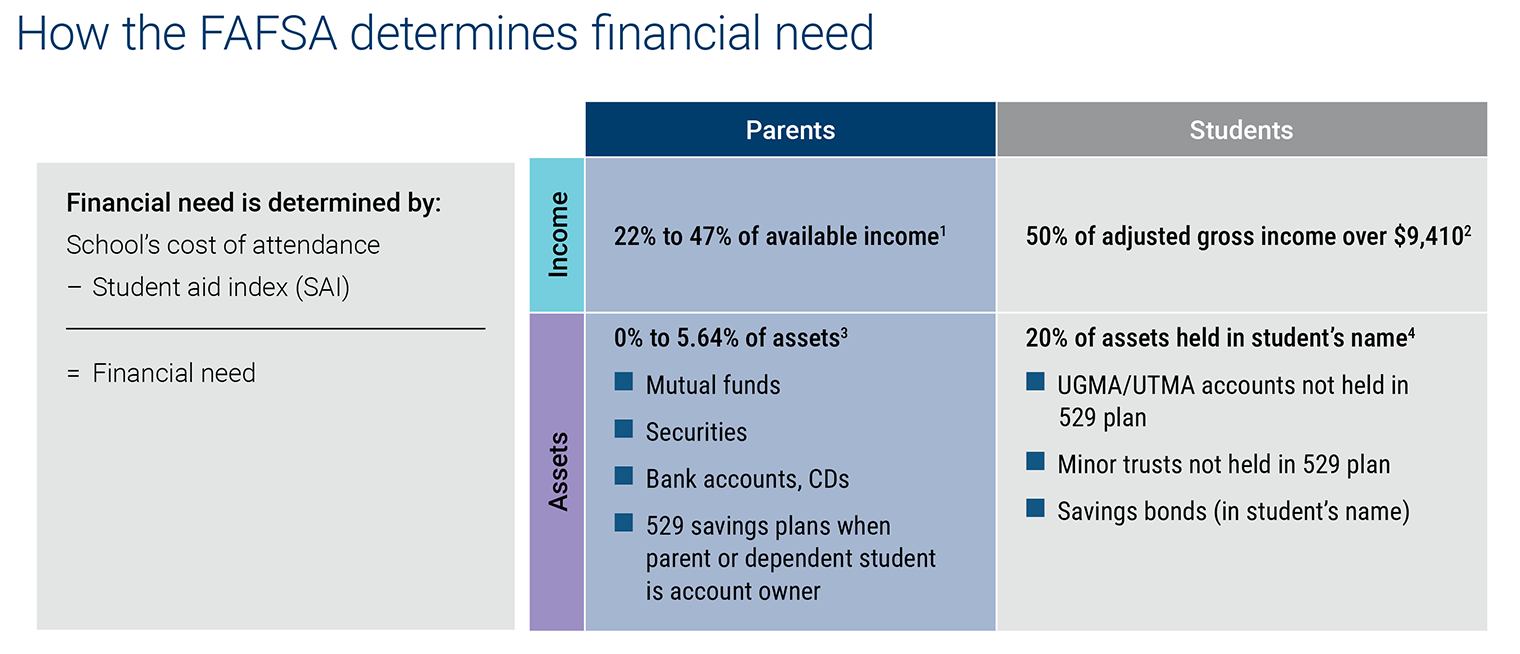

As the table above shows, up to 50% of annual student income can be deemed eligible for college use, which can have a big impact on needs-based aid eligibility. Meanwhile, parent-owned 529 plans, which are disclosed upfront on the FAFSA, are only evaluated as up to 5.64% available for college use (no more than any other nonqualified asset).

The new FAFSA questionnaire, which will be in effect for the 2024–2025 academic year, no longer requires students to manually disclose cash support on the FAFSA. As a result of the Consolidated Appropriations Act of 2021, all student income will be taken from tax return data, using the IRS Data Retrieval Tool (DRT). So grandparents can finally contribute significantly to the cost of their grandchildren’s education without impacting any needs-based financial aid eligibility.

What makes 529 plans attractive for grandparents

Even before this change was announced, 529 plans offered grandparents several advantages, including exclusive gifting and estate planning benefits. After all, many grandparents are either in their peak earning years or already retired. They’re likely thinking about their financial legacy, putting them in a great position to enjoy all the benefits of 529 accounts.

Consider how 529 assets are treated in the Internal Revenue Code:

529 accounts also benefit grandparents because they’re incredibly flexible. For example, if the beneficiary decides not to attend college, the account owner can easily change the beneficiary at any time. Equally important is the account owner’s ability to transfer ownership. Grandparents can maintain control while the beneficiary is still years away from college, in case they unexpectedly need the account assets for their own use, then can transfer ownership to the beneficiary’s parent when it’s time to take distributions for college expenses.

Bottom line

529 plans have always been a powerful college savings tool and a smart vehicle for grandparents looking to take advantage of gift and estate tax benefits. But until now, even these highly regarded features, combined with tax-free qualified distributions, haven’t always been powerful enough to overcome worries about potential impacts to financial aid. Thankfully, this is no longer a concern, and grandparents considering investing in a 529 plan to help send their grandchildren to college can now do so without fearing the financial-aid trap.

Columbia Management Investment Advisers, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.

Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies.

The views expressed are as of the date given, may change as market or other conditions change and may differ from views expressed by other Columbia Management Investment Advisers, LLC (CMIA) associates or affiliates. Actual investments or investment decisions made by CMIA and its affiliates, whether for its own account or on behalf of clients, may not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not take into consideration individual investor circumstances. Investment decisions should always be made based on an investor’s specific financial needs, objectives, goals, time horizon and risk tolerance. Asset classes described may not be appropriate for all investors. Past performance does not guarantee future results, and no forecast should be considered a guarantee either. Since economic and market conditions change frequently, there can be no assurance that the trends described here will continue or that any forecasts are accurate.

@2025 Columbia Threadneedle. All rights reserved.

CTBP240 (07/25) CTNA6789492.2